The evening rain in Shrawan reminds every Nepali entrepreneur of an inevitable truth: another fiscal year in Nepal is approaching, and with it comes both tremendous opportunity and unavoidable obligation. I’ll never forget sitting with Kamala Devi, who runs a successful handicraft export business from Bhaktapur, as she shared her hard-earned wisdom: “मित्र, business planning isn’t just paperwork—it’s the difference between surviving the monsoon and dancing in it.”

Her words capture why strategic preparation for Nepal’s fiscal year 2082/83 extends far beyond compliance requirements. Whether you’re steering a third-generation family trading house in Birgunj or launching Nepal’s next fintech innovation in Kathmandu, the fiscal year transition demands systematic attention that many businesses unfortunately discover too late.

This guide addresses the fundamental challenges facing Nepali entrepreneurs today. From understanding the Companies Act 2063 amendments to optimising annual planning strategies within Nepal’s unique economic environment, we’ll explore every dimension of successful financial forecast development and business strategy implementation. Having worked alongside hundreds of businesses through these transitions—from mountain tourism operators in Manang to agricultural cooperatives in Chitwan—I’ve witnessed how proper planning transforms uncertainty into competitive advantage.

ℹ Key Takeaways

Ready to transform your approach to Nepal’s fiscal year transition? Here’s what makes FY 2082/83 planning crucial for your business success:

- Nepal fiscal year 2082/83 brings new compliance requirements and opportunities

- Six-phase planning process starts in Chaitra for seamless business transitions

- Updated tax penalties under Finance Act 2080 make early preparation essential

- Digital government services offer 40-70% faster processing for prepared businesses

- Strategic timing of renewals and compliance can create competitive advantages

Understanding Nepal’s Fiscal Year 2082/83: More Than Dates on a Calendar (नयाँ आर्थिक वर्ष २०८२/८३ को बुझाइ)

Why Nepal’s Agricultural Heritage Still Shapes Modern Business Cycles

When the Nepal business calendar’s fiscal year runs from Shrawan 1 to Ashar 32, it reflects more than administrative convenience—it embodies our agricultural heritage that continues to influence business patterns across sectors. This timing, aligned with monsoon cycles and harvest seasons, creates opportunities and challenges that international business frameworks rarely address.

Consider the ripple effects across different sectors. A Dang-based rice processing cooperative experiences peak activity during harvest months, requiring substantial working capital and storage facilities. Meanwhile, a Lalitpur-based software development company finds its strongest quarters during the winter months when international clients finalise their annual budgets. Both operate within the same fiscal year business timeline, yet their planning requirements differ dramatically.

This agricultural foundation explains why traditional businesses, particularly those in rural areas, often struggle with annual business planning, a concept that urban enterprises consider routine. Family businesses that have operated seasonally for generations must now reconcile traditional wisdom with year-round financial planning obligations.

The cross-border complexity: Birgunj’s import-export businesses face unique challenges in coordinating with Indian suppliers operating on India’s fiscal year, which runs from April to March. This misalignment impacts inventory planning, payment terms, and cash flow management in ways that necessitate sophisticated financial planning strategies.

Nepal Rastra Bank’s Strategic Direction for FY 2082/83

The Nepal Rastra Bank guidelines for the upcoming fiscal year signal fundamental shifts in monetary policy that forward-thinking businesses are already incorporating into their strategic planning. Recent changes to foreign exchange regulations, particularly those impacting import-dependent companies, have created competitive opportunities for technologically adaptive enterprises.

The central bank’s emphasis on reducing cash transactions affects different sectors with varying intensity. Rural tourism operators in places like Gorkha may find digital payment requirements challenging due to infrastructure limitations, whereas urban e-commerce businesses view these changes as market advantages. Understanding these policy nuances becomes crucial for developing an effective business strategy for the financial year 2025/26.

Interest rate policy adjustments deserve particular attention in business financing strategies. With lending rates fluctuating based on economic indicators, businesses must build flexibility into their capital planning. This proves especially critical for seasonal businesses dependent on working capital loans during lean periods.

Current Regulatory Focus: Nepal Rastra Bank’s recent Foreign Exchange Management Regulations emphasise enhanced due diligence for businesses handling significant foreign currency transactions, particularly those exceeding NPR 1 million. Companies planning international expansion or substantial import activities must factor additional compliance costs and documentation requirements into their financial planning, fiscal year Nepal calculations.

Recent monetary policy meetings have emphasised financial inclusion and the promotion of digital transactions, creating opportunities for businesses that can adapt quickly to changing payment environments. The shift toward digital banking infrastructure offers efficiency gains for companies willing to invest in system upgrades and staff training.

Economic Realities That Make Planning Non-Negotiable

Can any business afford to ignore systematic planning when facing everything from monsoon-related supply disruptions to festival season cash flow volatility? The evidence from Nepal’s business environment provides a definitive answer.

During the last monsoon season, I observed two similar manufacturing operations in the Hetauda Industrial Area during the peak rainy period. The company, with a detailed business strategy, had mapped alternative transportation routes, established backup supplier relationships, and allocated cash reserves for weather-related delays. They maintained 85% production capacity while their unprepared competitor lost four weeks of operation and three major customers to more reliable suppliers.

Nepal’s geographical challenges aren’t merely inconveniences—they’re business planning imperatives that can determine success or failure. Power reliability varies dramatically between Kathmandu’s urban grid and remote mountain communities. Transportation costs can triple during monsoon road closures. Internet connectivity remains unpredictable in many rural areas despite recent infrastructure improvements.

Festival season economic patterns create both opportunities and cash flow challenges that require sophisticated planning. While Dashain and Tihar generate increased consumer spending worth billions of rupees nationally, they also put working capital pressures on businesses as employees demand advance payments and suppliers adjust their delivery schedules. Innovative businesses integrate these cultural and economic rhythms into their annual planning rather than treating them as operational disruptions.

Business Resilience Observation: Through my consulting experience across Nepal’s diverse business environment, I’ve consistently observed that businesses with formal planning processes demonstrate significantly higher resilience during economic disruptions. This pattern became particularly evident during the COVID-19 pandemic when prepared businesses adapted more quickly to changing conditions.

Systematic Business Planning for Nepal’s FY 2082/83 (व्यवस्थित व्यवसायिक योजना)

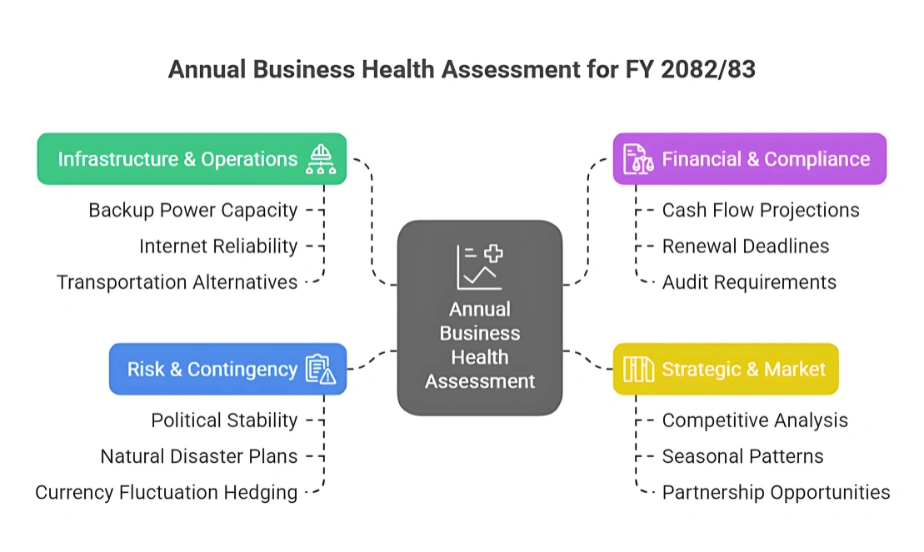

Conducting an Assessment That Reflects Nepal’s Business Environment

Traditional SWOT analysis requires fundamental adaptation for Nepal’s unique context, where political stability, infrastructure reliability, and community relationships often take precedence over conventional market factors. The Nepal business planning guide for fiscal year 2025/26 requires frameworks that address local realities, which international consultants usually overlook.

Political considerations extend beyond major policy announcements to include understanding how local election cycles, federal-provincial coordination challenges, and municipal leadership transitions affect business operations. A construction company in Surkhet, for instance, must factor political transition timelines into their project bidding strategies and contract negotiations.

Infrastructure assessment extends far beyond simply verifying the presence of electricity. Successful businesses evaluate backup power costs (averaging NPR 15-25 per unit for diesel generators), internet reliability for digital operations, and transportation accessibility during different seasons. These factors significantly impact both operational costs and the business compliance checklist Nepal requirements.

Regional Variations Matter: A textile manufacturer in Biratnagar faces different infrastructure challenges than a similar business in Nepalgunj. Proximity to Indian borders affects raw material costs, while local labour availability and skill levels vary significantly across regions.

Stakeholder mapping in Nepal includes traditional authority figures, community leaders, and informal influencers who may not appear on organisational charts but significantly influence business success. I’ve seen permit approvals accelerate dramatically when businesses invest time in understanding and respecting these relationship networks.

Community acceptance often determines whether businesses thrive or merely survive in Nepal’s relationship-based economy. A successful honey processing cooperative in Lamjung attributes its growth to involving local beekeepers in its ownership structure, rather than treating them as simple suppliers.

Developing a Strategy That Honours Local Wisdom While Embracing Global Practices

The most successful Nepali businesses don’t simply adopt international strategies—they create sophisticated hybrid approaches that honour local realities while capturing global opportunities. This synthesis becomes particularly crucial in the development of business strategies for Nepal’s diverse market conditions.

Market penetration strategies must take into account Nepal’s significant urban-rural economic disparities. What succeeds in Kathmandu’s competitive digital marketplace may fail in remote communities where personal relationships precede any transaction discussion. A mobile banking service achieved remarkable rural penetration not through advertising campaigns, but by partnering with local women’s cooperatives that already had established community trust networks.

Competitive analysis requires understanding both formal and informal sector dynamics that coexist throughout Nepal’s economy. Many businesses compete not only with registered companies but also with family-operated, informal enterprises that have lower overhead costs but limited growth potential. This reality shapes pricing strategies and value proposition development in ways that purely formal market analysis misses.

Digital transformation planning must strike a balance between efficiency gains and reliability requirements, given Nepal’s infrastructure limitations. A successful furniture manufacturer in Dharan implemented hybrid systems, utilising digital inventory management for efficiency during normal operations, while maintaining paper backup systems for reliability during frequent power outages.

Partnership strategies often succeed better than acquisition approaches due to Nepal’s limited capital availability and strong relationship-based business culture. Joint ventures, strategic alliances, and collaborative growth models typically outperform aggressive expansion strategies, which are more effective in developed markets.

Case Study Success: Sunrise Bank’s partnership approach with rural cooperatives has created a distribution network reaching over 500 communities, demonstrating how collaborative strategies can overcome infrastructure limitations while serving underbanked populations.

Financial Forecasting That Accounts for Nepal’s Economic Volatility

Creating accurate financial forecast projections in Nepal requires understanding factors that standard business textbooks often overlook—from the impact of currency fluctuations on import-dependent businesses to the cash flow patterns during festival seasons that can determine annual success or failure.

Revenue projection methods must incorporate Nepal’s economic volatility and pronounced seasonal patterns. A jute processing company in Biratnagar learned this lesson when its initial projections failed to account for international commodity price fluctuations affecting export revenues. Their refined approach now includes multiple scenario planning with flexible quarterly targets adjusted for global market conditions.

Cost management extends beyond normal operational expenses to include infrastructure reliability costs that businesses in developed markets never consider. Innovative businesses typically budget for backup power systems (15-20% of electricity costs), alternative transportation during road closures, and communication system redundancies.

Nepal Financial Reporting Standards (NFRS) compliance requirements add complexity to financial planning but also create opportunities for improved business management. Companies transitioning to NFRS often uncover operational inefficiencies while developing capabilities for improved financial decision-making and effective stakeholder communication.

Working Capital Reality: Seasonal businesses in Nepal typically require 40-60% more working capital than similar businesses in countries with stable infrastructure, primarily due to inventory buffer requirements and payment timing uncertainties.

Cash flow planning requires special attention to the impacts of the festival economy and government payment cycles. Many businesses experience their strongest sales during the Dashain and Tihar periods. Still, they must simultaneously manage employee festival bonuses, supplier advance payments, and inventory buildups that strain working capital during the same critical period.

Risk assessment frameworks must include political stability factors, natural disaster preparedness, and infrastructure failure contingencies that are often overlooked in international business planning models. A logistics company in Nepalgunj maintains detailed contingency plans for border closure scenarios, earthquake response procedures, and mapping alternative routes for the monsoon season—planning requirements that may seem excessive in more stable environments.

Learning from Nepal’s Entrepreneurial Community

The collective wisdom embedded in Nepal’s business forums and entrepreneur networks reveals patterns that formal research often misses entirely. These insights come from business owners who have dealt with multiple fiscal year transitions while building successful enterprises, despite facing infrastructure and regulatory challenges.

Family business succession during fiscal transitions creates unique opportunities for strategic review and leadership development. I’ve worked with several multi-generational businesses where fiscal year planning served as the framework for a gradual leadership transition, combining traditional business wisdom with modern management practices in ways that strengthened rather than disrupted business operations.

Collaborative approaches reflect Nepal’s community-oriented business culture, where businesses often support each other through challenging periods rather than viewing every interaction competitively. During the 2079/80 fuel crisis, a group of Pokhara-based tourism businesses shared transportation costs and coordinated guest transfers, maintaining operations collectively when individual responses would have failed.

Regional Innovation Examples:

- Chitwan’s agricultural cooperatives developed shared processing facilities that individual farmers couldn’t afford independently

- Ilam’s tea gardens created collaborative marketing approaches that strengthened the entire region’s brand recognition

- Banke’s timber businesses established joint sustainable forestry initiatives that improved both profitability and environmental compliance.

Common concerns shared across business forums include uncertainty about regulatory changes, challenges accessing growth capital, and difficulties finding skilled workers in rural areas. However, these discussions also reveal innovative solutions, such as skill-sharing programs, collaborative financing approaches, and technology adaptation strategies, that work within Nepal’s resource constraints.

| Compliance Type 📜 | Deadline ⏰ | Authority 🏛️ | Required Documents 📝 | Estimated Fees 💰 | Processing Time ⏳ |

|---|---|---|---|---|---|

| Company Registration Renewal | Within 3 months of FY end (Ashwin 2082 for FY 2081/82) | Office of Company Registrar (OCR) Nepal | Audited Financial Statements, AGM Minutes, Annual Return Form | NPR 1,000 – 25,000+ (based on paid-up capital) | 7-15 working days (online) |

| Municipal Business License Renewal | Kartik 30, 2082 BS (mid-Nov 2025) | Local Municipality (e.g., KMC) | Previous License, Tax Clearance, Property/Rent Docs | Varies widely by municipality & business type | 7-30 days |

| Annual Income Tax Filing (Company) | Poush end, 2082 BS (mid-Jan 2026, for FY 2081/82) | Inland Revenue Department (IRD) Nepal | Audited Financial Statements, Tax Calculation, Annexures | No direct filing fee (penalties for late filing) | Instant (online submission), assessment later |

| Monthly VAT Return Filing | 25th of the following month (e.g., Bhadra 25, 2082 for Shrawan) | Inland Revenue Department (IRD) Nepal | Sales & Purchase Invoices, VAT Ledger | No direct filing fee (penalties for late filing) | Instant (online submission) |

| Social Security Fund (SSF) Contribution | 15th of the following month (e.g., Bhadra 15, 2082 for Shrawan) | Social Security Fund (SSF) | Employee & Salary Details, Contribution Statement | Percentage of Basic Salary (Employer & Employee) | Instant (online submission) |

| Tourism License Renewal | Kartik 15, 2082 BS (early Nov 2025) | Department of Tourism / Relevant Bodies | Previous License, Tax Clearance, Compliance Certificates | NPR 5,000 – 50,000+ (varies by license type) | 7-21 days |

Note: This table provides a general guide for FY 2082/83. Specific deadlines and requirements may vary based on your business type, size, and local municipality. Always confirm with the respective government authority or a professional advisor.

Summary: Essential Nepal fiscal year 2082/83 business compliance calendar: key deadlines, required documents, and responsible authorities for company registration, tax filings, and license renewals. Your guide to annual business planning in Nepal.

Business Registration Renewal: Strategic Opportunity Disguised as Bureaucracy

While many businesses view business registration renewal in Nepal as an annual bureaucratic burden, strategic entrepreneurs recognise this process as a valuable business health check and optimisation opportunity. The Office of the Company Registrar (OCR) in Nepal has undergone significant modernisation, but success still requires systematic preparation and strategic thinking.

The renewal timeline begins four months before registration expiry, not when official reminders arrive. Innovative businesses integrate renewal preparation into their annual business planning cycle, treating it as an opportunity for strategic review rather than last-minute scrambling for paperwork.

Digital Transformation Progress: OCR Nepal’s online portal now handles the majority of renewal applications, significantly streamlining the process for well-prepared businesses. However, technical preparation remains crucial as system capabilities continue evolving. A Butwal-based trading company lost valuable time when it discovered that its financial statements weren’t in an acceptable digital format, forcing it to restart its application process during peak renewal season.

Documentation requirements extend beyond basic paperwork to include updated business plans, audited financial statements, and compliance certificates that provide valuable insights into business performance trends. Companies that maintain these records systematically throughout the year find renewal processes smoother, while gaining a better understanding of their operational efficiency patterns.

Cost Planning Reality: Complete renewal budgeting must include government fees (ranging from NPR 1,000 to NPR 25,000, depending on company size and authorised capital), professional service costs, document preparation time, and potential opportunity costs if renewals face delays during critical business periods.

Strategic businesses use renewal periods to evaluate their corporate structure, assess director and shareholder arrangements, and consider strategic changes, such as authorised capital increases or business activity expansions, that may benefit from timing coordination with renewal processes.

Company Compliance: Transforming Legal Obligations into Competitive Advantages

The Companies Act 2063 provisions aren’t merely legal requirements—they establish governance frameworks that can differentiate well-managed businesses in Nepal’s increasingly competitive marketplace. Understanding company compliance requirements, Nepal transforms obligations into strategic opportunities.

Annual return filing processes require detailed documentation of business activities, financial performance, and governance practices. Companies that maintain systematic records throughout the year find this process manageable, discovering operational insights that improve decision-making. Those treating it as an annual burden often uncover inefficiencies that cost far more than compliance investments.

Board governance requirements, including resolution documentation and shareholder meeting protocols, create accountability structures that strengthen business decision-making processes. A family-owned manufacturing company in Janakpur credits their compliance discipline with helping identify and resolve succession planning conflicts before they disrupt operations.

Regulatory Update: Recent amendments to the Companies Act, 2063 have introduced enhanced disclosure requirements for beneficial ownership, stricter audit standards for companies with paid-up capital exceeding NPR 10 million, and new digital filing procedures that require technical capability investments. These changes, while initially implemented through ordinance provisions, are now being codified into a permanent legislative framework.

Competitive Advantage Insight: Well-managed compliance processes signal reliability to suppliers, credibility to customers, and trustworthiness to financial institutions, thereby creating competitive advantages that substantially exceed the costs of compliance.

Recent audit requirement changes, particularly those affecting mid-sized companies, are notable. Businesses with an annual turnover exceeding NPR 50 million are now required to undergo statutory audits, regardless of their company structure, as stipulated under Section 108 of the Companies Act, 2063, and related provisions of the Income Tax Act. This requirement applies even to private limited companies post-recent amendments, creating opportunities for proactive audit planning rather than reactive compliance scrambling.

Nepal Business License Renewal and Municipal Coordination

Nepal’s federal structure means that Nepal’s business license renewal requirements vary significantly across its 753 local units, creating both challenges and strategic opportunities for multi-location businesses. What works efficiently in Kathmandu Metropolitan City’s streamlined processes may not apply in smaller municipalities with limited technical capabilities.

Municipal Variations Create Planning Complexity:

- Kathmandu Metropolitan: Online applications, 15-day processing, integrated fee payment systems

- Pokhara Metropolitan: Hybrid system, 21-day processing, separate department coordination required

- Smaller municipalities: Often paper-based, 30+ day processing, in-person requirements

Departmental coordination in Nepal becomes crucial for businesses requiring industrial licenses and permits. The recent policy emphasis on “one-stop service delivery” reveals significant variations in implementation across regional offices, necessitating flexible planning approaches and realistic timeline expectations.

Sector-specific licensing requirements create unique compliance calendars for businesses in the tourism, manufacturing, and trading sectors. A Chitwan-based adventure tourism company maintains detailed tracking systems for multiple license renewals while building strategic relationships with different regulatory agencies to ensure smooth processing.

Nepal business permit renewal deadline fiscal year varies by permit type and issuing authority: Company Registrations require renewal applications 60 days before expiry dates, Municipal Business Licenses typically need renewal by Kartik 30 (mid-November), Industrial Permits follow Department of Industry Nepal timelines varying by sector, Tourism Licenses require renewal by Kartik 15 for following season operations, and Import/Export Licenses need renewal 30 days before expiry to avoid operational disruptions.

Important Note: While these are general deadlines observed across most jurisdictions, businesses should always confirm specific renewal dates with their respective municipal or sectoral authorities, as minor variations may exist based on local regulations.

Best Practice Observation: Businesses operating across multiple municipalities often designate compliance coordinators for each location, building local relationships and understanding specific procedural requirements rather than attempting centralised management from headquarters.

Addressing Costly Misconceptions About the Business Renewal Process in Nepal

Through years of consulting across Nepal’s diverse business environment, I’ve encountered recurring misunderstandings that cost businesses substantial time, money, and competitive opportunities. Addressing these misconceptions proactively saves resources while reducing stress during critical transition periods.

The Most Expensive Misconception: Assuming all renewal processes follow similar timelines and requirements. Different agencies operate on entirely different schedules, require varying documentation standards, and offer dramatically different service levels that demand customised preparation approaches.

Professional consultation offers excellent value when addressing complex multi-agency renewals, navigating regulatory changes, or managing time-sensitive business situations. However, routine renewals for established businesses often work well with internal management once proper systems are in place and relationships have been established.

Cost-Benefit Analysis Framework: Compare professional service investments against potential risks of compliance failure. A delayed company registration renewal may cost over NPR 500,000 in lost business opportunities compared to an investment of NPR 50,000 in proper professional support during complex situations.

Agency coordination becomes particularly critical when businesses require approvals from multiple levels of government. Understanding which authority handles specific renewal aspects prevents applications from getting lost in bureaucratic confusion while building relationships that facilitate future interactions.

Regional Reality Check: Renewal experiences vary dramatically between urban centres with established infrastructure and rural areas where personal relationships and local knowledge often prove more valuable than formal procedures.

Strategic Tax and Financial Planning for FY 2082/83 (कर र वित्तीय रणनीति)

Annual Tax Planning: Optimising Within Nepal’s Evolving Framework

The Inland Revenue Department Nepal (IRD) (आन्तरिक राजस्व विभाग नेपाल) has undergone significant modernisation. Still, successful annual tax planning in Nepal requires an understanding of both digital capabilities and the underlying policy intentions that drive regulatory decisions.

VAT registration requirements in Nepal involve a strategic threshold analysis rather than automatic registration when annual sales exceed NPR 2 million. Businesses should evaluate timing decisions, administrative burden increases, and competitive implications before registration rather than waiting until legal requirements force their choices.

Strategic Timing Consideration: Voluntary VAT registration can offer input tax credit advantages for businesses with substantial purchase costs, even those below the mandatory thresholds. A Bhairahawa-based import business saved NPR 300,000 annually through strategic early registration.

PAN registration business Nepal processes have been streamlined through digital systems, but maintaining accurate records and timely updates remains crucial for avoiding complications during tax assessments or business transaction processing. Recent system upgrades allow real-time verification, improving business-to-business transaction efficiency.

Income tax planning strategies vary dramatically between sole proprietorships, partnerships, and company structures. A textile business in Biratnagar discovered substantial savings by restructuring their ownership arrangement, optimising tax efficiency while maintaining operational flexibility and family control.

Policy Update: Finance Act 2080 introduced revised penalty structures for late submissions (now 0.1% daily up to 25% of tax liability for both income tax and VAT filings), new audit selection criteria emphasizing risk-based assessments rather than random selection, and enhanced digital filing requirements that reward businesses with systematic record-keeping and real-time compliance.

Tax optimisation strategies must balance legal minimisation with operational efficiency considerations. Sometimes, the lowest tax option creates administrative burdens or operational constraints that cost more than tax savings, requiring a thorough business impact analysis rather than purely tax-focused decisions.

Business Audit Requirements: Beyond Compliance to Business Intelligence

Many Nepali businesses approach audits reactively, but proactive audit planning provides valuable business insights while ensuring compliance with the Nepal Standards on Auditing (NSA), which can improve operational efficiency and stakeholder confidence.

Mandatory Audit Triggers (Updated for FY 2082/83):

- Companies with paid-up capital exceeding NPR 10 million

- Businesses with an annual turnover above NPR 50 million

- Financial institutions, regardless of size

- Public companies and their subsidiaries

- Cooperative societies with specific activity thresholds

The implementation of Nepal Standards on Auditing (NSA) creates opportunities for business process improvement beyond basic compliance requirements. Companies engaging constructively with audit processes often discover operational inefficiencies, internal control weaknesses, and strategic opportunities that justify audit investments through improved business performance.

Auditor selection involves balancing cost considerations with expertise requirements and relationship management capabilities. The cheapest auditor may not provide insights and support that create business value beyond basic compliance requirements, while overly expensive auditors may not justify their costs for routine audit requirements.

Tax clearance certificates in Nepal require detailed documentation of tax compliance and business operations. Companies with systematic record-keeping find this routine manageable, while those with inconsistent documentation face delays and additional scrutiny that can disrupt business operations and harm stakeholder relationships.

Audit Preparation Best Practices:

- Organise financial records quarterly rather than annually

- Document internal control procedures and their effectiveness

- Prepare supporting documentation for unusual transactions

- Establish an audit committee or designate a liaison for larger businesses

- Schedule audit timing to minimise operational disruptions

Strategic audit planning can provide competitive advantages through improved financial reporting, enhanced internal controls, and better stakeholder communication that builds business credibility and facilitates access to capital or partnership opportunities.

NFRS Implementation: International Standards, Local Adaptation

The transition to Nepal Financial Reporting Standards (NFRS) represents more than accounting changes—it’s a strategic opportunity to align financial management with international best practices while maintaining sensitivity to Nepal’s unique business environment and stakeholder expectations.

NFRS Implementation Timeline (Mandatory Adoption):

- Public companies: Already required

- Financial institutions: Phased implementation ongoing

- Large private companies (NPR 500 M+ revenue): FY 2082/83

- Medium companies (NPR 100 M+ revenue): FY 2083/84

- Small companies: Simplified NFRS or Nepal Accounting Standards option

Early adoption of NFRS often provides competitive advantages in accessing capital, attracting investors, and building stakeholder confidence. A Pokhara-based hotel group’s early adoption helped secure international franchise opportunities by demonstrating financial credibility to global partners through its early adoption.

Financial reporting system upgrades required for NFRS compliance often reveal operational inefficiencies and control weaknesses that companies can address proactively. Treating NFRS implementation as a business improvement opportunity rather than a compliance burden frequently yields better results and stronger long-term business capabilities.

Working Capital Management Strategies must account for fiscal year transitions, seasonal business patterns, and regulatory payment requirements that can create cash flow pressures during transition periods. Effective planning prevents liquidity crises during tax payment concentrations or renewal fee periods.

Nepal Rastra Bank coordination becomes essential for businesses in regulated sectors or those requiring banking relationships for growth financing. Understanding NRB policy directions helps companies to align their financial planning with regulatory expectations and access available support programs.

Quarterly financial review processes provide opportunities for course correction and performance optimisation rather than waiting for annual assessments that may identify problems too late for effective intervention. Regular financial health monitoring enables proactive management rather than reactive crisis response.

Exploring Nepal’s Tax Framework: Professional Insights from the Field

Having guided numerous businesses through tax optimisation strategies across Nepal’s diverse economic environment, I’ve learned that successful tax planning requires balancing regulatory compliance with business growth objectives. This delicate equilibrium varies significantly by business size, sector, and geographical location.

Common Tax Planning Mistakes that prove costly during audits:

- Focusing exclusively on current-year optimisation without considering multi-year implications

- Ignoring the administrative burden of complex structures that offset tax savings

- Failing to coordinate tax planning with business operational requirements

- Underestimating documentation requirements for tax positions

- Missing deadline-driven opportunities for tax-efficient structuring

Seasonal considerations in Nepal’s fiscal calendar affect tax payment timing, cash flow planning, and business operation scheduling in ways that require sophisticated coordination. Innovative businesses align their operational cycles with tax obligations to minimise financial strain and operational disruptions.

Relationship Building Strategy: Productive partnerships with tax advisors and IRD officials require professional respect, consistent compliance, and proactive communication rather than adversarial approaches that create unnecessary complications and audit scrutiny.

Ethical considerations involve balancing tax optimisation with social responsibility in Nepal’s developing economy, where tax revenues fund critical infrastructure and social services that benefit business operations. Successful businesses contribute appropriately to national development while managing their tax obligations efficiently and transparently.

Future Preparation Trends:

- Digital economy taxation affecting online businesses

- International tax coordination requirements for multinational operations

- Environmental tax incentives for sustainable business practices

- Technology-based tax collection and monitoring systems

Leveraging Resources While Overcoming Common Barriers (स्रोत सदुपयोग र बाधा समाधान)

Maximising Digital Government Services in Nepal’s Evolving Environment

The acceleration of digitisation in Nepal’s government services offers substantial time and cost savings. Still, many businesses haven’t optimised their use of the Nepal Business Portal and related digital platforms, which can dramatically improve operational efficiency.

Portal Optimisation Strategies:

- Understanding which services function reliably online versus requiring physical presence

- Preparing digital documents in acceptable formats before starting applications

- Timing submissions during off-peak hours for better system performance

- Maintaining backup documentation for system failure scenarios

Department of Industry Nepal online services have expanded significantly, offering application tracking, status updates, and document submission capabilities that reduce processing times for well-prepared businesses. However, technical literacy requirements and intermittent connectivity issues still create barriers for some users, particularly in rural areas.

Integration Success Story: A Hetauda-based cement manufacturer streamlined their regulatory compliance by integrating government portal notifications with their internal planning systems, reducing compliance processing time by 60% while improving deadline management accuracy.

Technical Support Ecosystem includes government help desks, private consultants, and peer business networks that help overcome digital transition challenges. Building these support relationships before crises creates better outcomes than emergency assistance requests during deadline pressures.

Cost-Benefit Analysis: Based on case studies and implementation experience, businesses that invest in digital service adoption typically see reductions of 40-70% in compliance processing time and 25-50% in related costs. However, implementation requires initial training investments and system setup costs, which can discourage some traditional businesses.

The key lies in gradual implementation rather than attempting complete digital transformation immediately. Starting with simpler processes and building capability systematically often works better than ambitious digitisation projects that overwhelm existing business capabilities.

Investment Board Nepal: Expanding Opportunities Beyond Large FDI

While the Investment Board Nepal is primarily associated with major foreign direct investment projects, smaller businesses can benefit significantly from understanding economic development priorities and incentive structures it promotes throughout Nepal’s economy. Domestic companies in the manufacturing, energy, tourism, or technology sectors that can supply to or partner with IBN-facilitated projects often discover unexpected growth opportunities.

Local Business Connection Opportunities:

- Supply chain partnerships with international investors

- Technical collaboration possibilities through technology transfer programs

- Market expansion potential through international distribution networks

- Skill development opportunities through capacity-building initiatives

Government incentive programs during fiscal year 2082/83 include tax holidays for qualifying businesses in priority sectors, infrastructure support for industrial development, and regulatory facilitation for export-oriented enterprises. Understanding these opportunities helps companies to align their growth strategies with available support programs.

Special economic zones in Bhairahawa and Simara offer qualifying businesses access to infrastructure, regulatory facilitation, and market connectivity that may not be available in traditional business locations. These zones prioritise export-oriented enterprises with minimum investment thresholds and specific sector focuses. However, evaluating these options requires understanding both the benefits and operational constraints of special zone requirements, including mandated export quotas and location-specific regulations.

Partnership Development Case Study: A Dhangadhi-based furniture manufacturer partnered with a European importer through Investment Board facilitation, gaining access to design expertise, quality certification support, and international market access that increased their revenue by 180% within two years.

The key to maximising Investment Board relationships lies in understanding how smaller businesses can complement larger investment initiatives rather than competing directly with well-capitalised international players. Strategic positioning as reliable local partners often creates opportunities that independent market entry approaches cannot achieve.

Overcoming Persistent Business Planning Misconceptions

Research throughout Nepal’s business communities reveals persistent misunderstandings about fiscal year business planning that prevent many enterprises from maximising their potential. Addressing these misconceptions directly can unlock significant competitive opportunities.

Timeline misconceptions often involve assuming fiscal year planning begins with Shrawan, when effective planning starts during Chaitra, with assessment, goal setting, and resource preparation that enables smooth transitions rather than crisis management approaches.

Complexity Fears discourage many businesses from systematic planning, but basic planning frameworks adapted to Nepal’s context prove more accessible than many entrepreneurs assume. Starting with simple systems and gradually adding sophistication often works better than attempting thorough planning from the outset.

Cost-Benefit Myths include both overestimating planning costs and underestimating reactive management expenses. Systematic analysis consistently demonstrates that planning investments saves substantially more than they cost through improved efficiency, reduced crisis management, and better opportunity capture.

Technology Assumptions either overestimate digital requirements or underestimate the benefits of technology for Nepali businesses. Appropriate technology adoption can dramatically improve business efficiency without requiring sophisticated systems or substantial investments if approached strategically.

Evidence from Successful Businesses: Companies overcoming common planning barriers create competitive advantages that compound over time, suggesting that planning investment generates increasing returns as businesses develop systematic capabilities and market understanding.

The solution lies in starting with basic planning approaches and building capability gradually rather than waiting for perfect conditions or attempting a thorough system immediately. Minor improvements often generate momentum for larger planning investments as businesses experience tangible benefits.

Ethical Business Practices in Nepal’s Developing Economy

As Nepal’s economy develops rapidly, businesses face increasing expectations to balance profit optimisation with social responsibility—a challenge requiring thoughtful integration of ethical considerations into Nepal’s fiscal year 2082/83 planning processes.

Stakeholder Capitalism Approach involves balancing shareholder returns with community development, employee welfare, and environmental sustainability in ways that strengthen rather than constrain business growth opportunities. Successful businesses discover that ethical practices often create competitive advantages rather than cost burdens.

Environmental Considerations in Nepal’s ecologically sensitive context necessitate an understanding of local environmental impacts, climate change vulnerabilities, and sustainable business practices that protect long-term business viability while contributing to national environmental goals and international climate commitments.

Community Engagement Strategies that contribute to local development while supporting business growth include local hiring priorities, supplier development programs, and community investment initiatives that build business support while creating shared value and sustainable competitive advantages.

The Cultural Sensitivity Framework requires respecting Nepal’s diverse business cultures while pursuing growth objectives, maintaining ethical standards, and building inclusive business practices that honour traditional values while embracing beneficial modern approaches and international best practices.

Personal Reflection: Working with businesses across Nepal’s diverse environment has convinced me that ethical practices enhance long-term business success by building stakeholder trust, reducing regulatory risks, and creating sustainable competitive advantages that purely profit-focused approaches frequently miss. The businesses that integrate social responsibility into their core planning consistently outperform those treating ethics as optional considerations.

Frequently Asked Questions

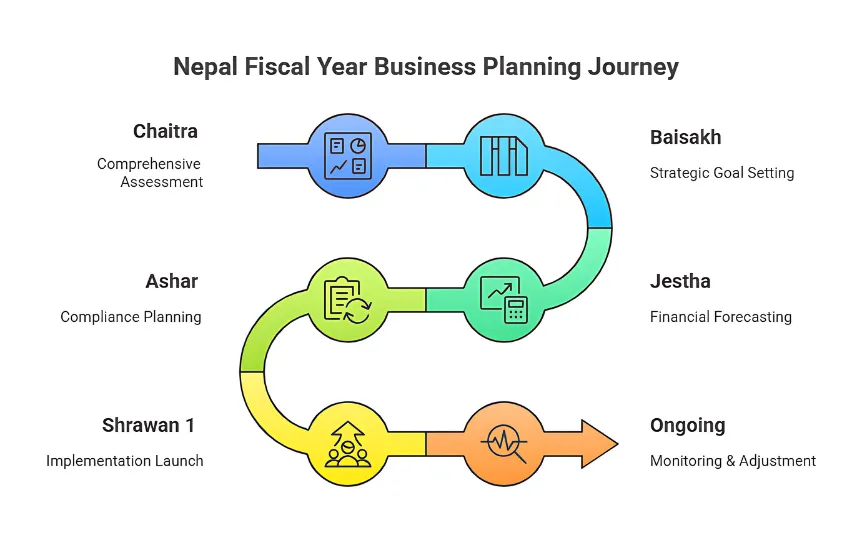

Step by step business planning Nepal fiscal year process involves six critical phases: (1) Thorough Assessment including financial performance analysis, compliance status review, and market position evaluation, (2) Strategic Goal Setting aligned with Nepal’s economic conditions and regulatory environment, (3) Financial Forecasting that accounts for seasonal variations, infrastructure challenges, and currency fluctuation risks, (4) Compliance Planning for all renewal requirements and regulatory obligations, (5) Resource Allocation and detailed timeline development with quarterly milestones, and (6) Implementation Monitoring with monthly review cycles and quarterly adjustment mechanisms.

The process should begin during Chaitra (March-April) with assessment activities, continue through goal setting and planning during Baisakh-Jestha, and culminate in implementation preparation during Ashar before the fiscal year transition.

Business compliance checklist Nepal for FY 2082/83 includes: Company Registration Renewal with OCR Nepal (due 60 days before expiry), Municipal Business License Renewal (typically by Kartik 30), VAT and Income Tax Filings with IRD according to registration category, Annual Return Submission including financial statements and governance documentation, Statutory Audit Requirements for qualifying businesses exceeding NPR 50 million turnover, Nepal Standards on Auditing (NSA) compliance for audited companies, Nepal Financial Reporting Standards (NFRS) implementation for applicable businesses, and Tax Clearance Certificate maintenance for ongoing operations.

Requirements vary significantly by business size, structure, and sector, with manufacturing businesses facing additional Department of Industry coordination requirements.

Nepal business permit renewal deadline fiscal year varies by permit type and issuing authority: Company Registrations require renewal applications 60 days before expiry dates, Municipal Business Licenses typically need renewal by Kartik 30 (mid-November), Industrial Permits follow Department of Industry Nepal timelines varying by sector, Tourism Licenses require renewal by Kartik 15 for next season operations, and Import/Export Licenses need renewal 30 days before expiry to avoid operational disruptions.

Critical Planning Timeline: Begin renewal preparation 90 days before deadlines to ensure adequate processing time and avoid last-minute complications that could disrupt business operations.

Tax clearance certificate Nepal process requires: (1) Current Tax Registration Verification with IRD, (2) Complete Tax Payment of all outstanding obligations including penalties, (3) Required Return Filing submission for all applicable periods, (4) IRD Application with Form 4.1 and supporting documents, (5) Review Process completion (typically 7-15 working days for complete applications), and (6) Certificate Issuance for valid business operations.

Maintain systematic tax records throughout the year and ensure all compliance obligations are current before application submission to avoid processing delays that could affect business operations.

Company Registration Renewal involves OCR Nepal for corporate legal status maintenance, focuses on governance compliance and financial reporting requirements, and affects fundamental business legal existence and stakeholder relationships. Business License Renewal involves municipal or sectoral authorities for operational permission maintenance, focuses on operational compliance and local regulation adherence, and affects business operation authorization and day-to-day activities.

Both processes are mandatory but serve different regulatory purposes: company registration establishes legal entity status while business licenses authorize specific operational activities. Successful businesses coordinate both renewal processes within their thorough compliance planning rather than treating them as separate obligations.

Your Fiscal Year 2082/83 Success Starts With Today’s Decisions

The transition into Nepal’s fiscal year 2082/83 represents a defining moment for every business operating in our dynamic economy. Whether you’re stewarding a traditional family enterprise that has weathered decades of change or launching an innovative startup that embodies Nepal’s entrepreneurial future, the strategic principles explored in this guide provide your roadmap to sustainable success.

The Choice Before You: You can approach the fiscal year transition reactively, scrambling to meet deadlines and hoping to avoid complications, or you can embrace systematic planning that transforms uncertainty into competitive advantage. The businesses that choose strategic preparation consistently outperform those that rely on reactive management.

Immediate Action Steps for Success:

- Begin your thorough business assessment within the next two weeks

- Schedule compliance review meetings with your professional advisors

- Develop your strategic goals aligned with Nepal’s evolving economic environment

- Integrate financial planning with regulatory requirements for optimal efficiency

- Build the systematic planning capabilities that will distinguish your business

Remember Kamala Devi’s wisdom from Bhaktapur: business planning isn’t merely paperwork—it’s the foundation that enables businesses to dance in the monsoon rather than survive it. The strategic decisions you make today will determine whether your business thrives or struggles throughout the Nepal fiscal year 2082/83.

Your Planning Journey Begins Now: The most successful businesses in Nepal’s economy will be those that start their fiscal year preparation immediately, building the planning capabilities and strategic relationships that create lasting competitive advantages. The transition into FY 2082/83 offers unprecedented opportunities for businesses prepared to seize them systematically and strategically.

Take action today: Begin your assessment, engage your advisors, and start building the planning foundation that will drive your business success throughout the new fiscal year and beyond. Your future growth depends on the planning decisions you implement today.