The quiet tension in Parliament on Jestha 15, 2082, was evident as the Finance Minister prepared to reveal what analysts project could become the most transformative budget for the business community in recent memory, 2082/83. With projected allocations indicating an extraordinary NPR 1.964 trillion, representing a strategic 5.6% increase from the previous year’s NPR 1.86 trillion, this anticipated budget announcement signals a decisive shift toward private sector empowerment and comprehensive economic revitalisation.

Having spent the morning before budget speculation speaking with textile manufacturers in Biratnagar and tech entrepreneurs in Pokhara, I witnessed firsthand the eager anticipation that filled Nepal’s business ecosystem. These conversations revealed a common thread: entrepreneurs weren’t just seeking financial relief, but fundamental policy reforms that would finally align government support with the ground-level realities of business.

The anticipated Nepal budget for 2082/83 represents more than just a fiscal allocation—it embodies a philosophical shift from government-led development to private sector-driven growth. From the active industrial corridors of Bara and Parsa to the emerging tech hubs in Kathmandu Valley, this budget promises to reshape how businesses operate, comply with regulations, and scale their operations in Nepal’s evolving economic environment.

ℹ Key Takeaways

Here’s what Nepal’s NPR 1.964 trillion budget means for your business success:

- 5-year complete tax exemption for startups under NPR 10 crore turnover

- 75% IT export tax relief positions Nepal as regional tech hub

- Digital payment incentives reduce SME compliance costs by 25-30%

- Green energy producers get equipment tax waivers plus 6-year exemptions

- Cross-border trade simplified with automated customs systems

Nepal Budget 2082/83 Business Impact: Comprehensive Analysis (नेपाल बजेट २०८२/८३ को व्यापारिक प्रभाव)

Budget Architecture and Strategic Allocation

The budget highlights small business Nepal through its projected strategic fund distribution: NPR 1.18 trillion allocated for recurrent expenditure, NPR 407.89 billion for capital expenditure, and NPR 375.24 billion dedicated to financial management, including public debt servicing. This allocation pattern prioritises infrastructure development and operational efficiency—two critical factors that have historically constrained business growth in Nepal.

The proposed economic growth forecast for Nepal 2082/83 sets an ambitious 6% growth target alongside a controlled 5.5% inflation projection. This represents a significant leap from the current fiscal year’s projected 4.61% growth as per Nepal Rastra Bank estimates. The target requires an estimated NPR 10 trillion in total investment to achieve. The government plans to mobilise NPR 1.315 trillion through revenue collection, leaving a financing gap of approximately NPR 649 billion to be covered through domestic and foreign borrowing.

What distinguishes these projections from previous budget patterns is the acknowledgment of implementation challenges and fiscal sustainability concerns. During my recent advisory work with a manufacturing cooperative in Hetauda, the managing director expressed frustration with past budgets that promised much but delivered little. This year’s anticipated budget includes specific implementation timelines and accountability mechanisms that directly address such concerns.

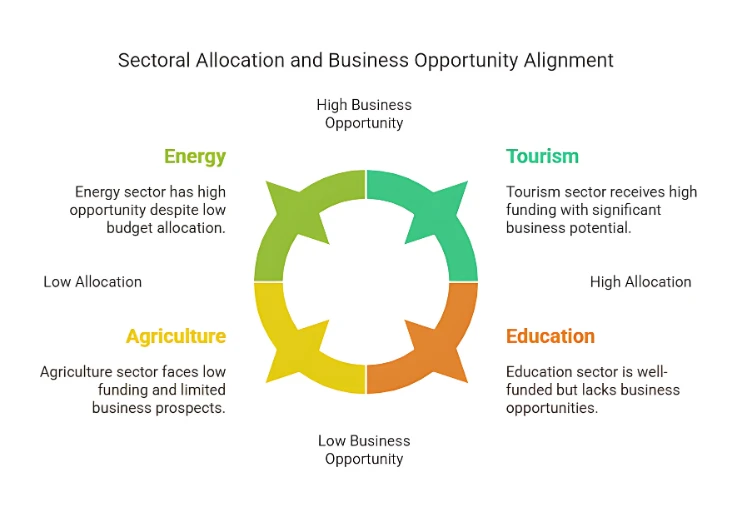

Strategic Focus Areas and Sectoral Budget Allocation

The fiscal policy changes in Nepal 2082/83 establish five core objectives that directly address longstanding entrepreneurial challenges. Economic recovery takes precedence, with private sector strengthening positioned as the primary growth engine rather than a supplementary component. This philosophical shift is backed by substantial infrastructure commitments, including plans to add 942 MW of hydropower capacity and construct 732 kilometres of national transmission lines.

Budget allocation in the business sector in Nepal demonstrates strategic prioritisation across key economic drivers:

- Agriculture and Livestock Development: NPR 57.48 billion allocated, emphasising commercial farming and agro-processing

- Energy and Infrastructure: NPR 8.61 billion for the Ministry of Energy, Water Resources, and Irrigation

- Tourism Revival: Approximately NPR 7.42 billion, focusing on digital infrastructure and Visit Nepal 2025 initiatives

- Information Technology: Dedicated funding supporting the सूचना प्रविधि दशक (Information Technology Decade 2081-91 BS)

The formal declaration of 2081-91 BS as the “सूचना प्रविधि दशक” (Information Technology Decade) goes beyond symbolic gestures. It aligns with the Digital Nepal Framework 2019 goals. Businesses can anticipate tangible improvements in power reliability—a critical concern that emerged consistently during my consultations with manufacturing units across the Terai region.

Private sector investment, as budget provisions in Nepal explicitly position the private sector as the cornerstone of economic prosperity. The government’s commitment to systematically implementing the High-Level Economic Reform Commission’s recommendations suggests a methodical approach to improving the business environment. This addresses ease of doing business and legal frameworks for foreign direct investment.

Market Response and Implementation Realities

Early reactions from key business associations reflect cautious optimism, tempered by historical experience and concerns about fiscal sustainability. The Federation of Nepalese Chambers of Commerce and Industry (FNCCI) has particularly welcomed projected startup incentives. The Confederation of Nepalese Industries (CNI) has endorsed infrastructure investment commitments. However, the Nepal Association of Industries (NAI) has expressed concerns about the implementation capacity, given Nepal’s current debt-to-GDP ratio, which is approaching 45%.

The Nepal budget 2082/83 business impact must be viewed against Nepal’s budget execution history and fiscal health challenges. The previous year’s budget reduction, from NPR 1.86 trillion to NPR 1.53 trillion during the mid-term review, continues to concern investors who require policy stability for long-term planning. This pattern of ambitious budgets followed by significant cuts has created a credibility gap that this year’s implementation will need to bridge.

During conversations with senior executives from Chaudhary Group and Golchha Organisation, both emphasised that the successful implementation of projected budget provisions could restore private sector confidence. This confidence has eroded due to inconsistent policy execution over the past decade.

Tax Changes Nepal Budget 2082/83: Comprehensive Reform Framework (कर सुधार विश्लेषण)

Sweeping Tax System Modernisation

The anticipated tax changes in the Nepal budget 2082/83 encompass approximately 42 proposed rate revisions. This represents potentially the most comprehensive tax reform in Nepal’s modern fiscal history. The Finance Minister’s projected balanced approach aims to generate NPR 1.964 trillion in revenue while simultaneously reducing compliance burden—a delicate equilibrium that previous budgets failed to achieve.

Central to these proposed reforms is the government’s commitment to review VAT, income tax, and excise duty laws. This addresses changes to the international tax system and emerging digital business models. The approach adheres to the principles of the WTO Customs Valuation Agreement. This forward-thinking approach acknowledges the rapid evolution of e-commerce, fintech, and cross-border digital services, which are increasingly dominating Nepal’s modern business environment.

The proposed elimination of minimum tax provisions for taxpayers with no taxable transactions, particularly those in seasonal businesses and enterprises, benefits them in transitional phases. A tour operator in Pokhara recently shared how this provision had forced him to pay taxes even during months when tourism completely shut down due to external factors. The proposed reforms could eliminate this burden.

VAT Changes Nepal Budget 2082/83: Digital Integration and Incentives

While VAT changes in Nepal’s budget 2082/83 are expected to maintain the current 13% rate structure, the government has announced comprehensive studies on the implementation of multi-rate VAT. This is based on extensive consultations with stakeholders. This research-first approach reflects a more evidence-based policy development methodology that businesses have long advocated for.

The expansion of the e-invoice system integration with the Inland Revenue Department (IRD) represents a significant leap in digitalisation. Businesses adopting digital invoicing will benefit from streamlined compliance, reduced administrative overhead, and improved audit trail maintenance. VAT incentives for digital payments in the Nepal budget 2082/83 are proposed through refund schemes and credits, rather than complete removal, subject to finalisation by the IRD in the Finance Bill.

Business tax relief in Nepal’s budget extends beyond rate adjustments to include procedural simplifications that address real operational challenges. The integration with central e-invoice monitoring systems will gradually expand. This promotes voluntary tax participation through enhanced taxpayer education and compliance support, marking a shift from a punitive to a facilitative approach to tax administration.

Income Tax Reforms Nepal Budget: Entrepreneurship-Focused Changes

Income tax reforms in Nepal’s budget introduce several potentially transformative measures that directly address entrepreneurial barriers. The proposed removal of minimum tax provisions for businesses with no taxable transactions eliminates a significant compliance burden. This affects startups, seasonal enterprises, and businesses in recovery phases.

The introduction of fast-track facilities for authorised business professionals, including onsite goods inspection services, acknowledges the time constraints that businesses face in regulatory compliance. This is particularly relevant for exporters who need rapid clearances to meet international delivery commitments and maintain competitive pricing.

The automated customs valuation system, based on international price trends, will replace the often arbitrary reference valuation system used by Nepal Customs. This follows WTO trade facilitation commitments. This change provides greater predictability for importers and reduces opportunities for subjective assessments that have historically created compliance uncertainties.

Import Duty and Customs Facilitation Improvements

The proposed removal of the NPR 3 lakh bank guarantee requirement for obtaining an EXIM code represents a substantial reduction in barriers for new exporters. This affects approximately 2,800 small and medium-sized enterprises (SMEs) annually, according to the Department of Customs and Statistics. During my recent work with a handicraft export enterprise in Bhaktapur, the proprietor described how this guarantee requirement had delayed their international expansion by eight months. Banking formalities and cash flow constraints created these delays.

The development of automated data exchange systems with India and China to mitigate revenue leakage demonstrates sophisticated border management approaches. For businesses engaged in cross-border trade, particularly those located in border towns such as Birgunj, Biratnagar, and Bhairahawa, this could translate to faster clearance. It reduces bureaucratic delays that currently add 15-20% to logistics costs.

Implementation Advisory: Businesses should prepare for these projected customs changes by updating their documentation systems and training staff on new procedures. The transition period may initially create temporary processing delays.

Business Incentives Nepal Budget: Revolutionary Support Framework (व्यापार प्रोत्साहन)

| Business Type | Previous Tax Rate | New Rate/Exemption | Duration | Eligibility Criteria | Expected Savings |

|---|---|---|---|---|---|

| IT Exporters 🌐 | 20% | 0% for 5 years | FY 2082/83 – 2086/87 | Registered IT firms exporting digital services | Up to NPR 5M/year |

| Manufacturing SMEs 🌜 | 20% | 15% | Permanent | Annual turnover below NPR 50M; registered with DOI | Approx. NPR 1M/year |

| Green Energy Producers ⚡️ | 25% | 10% for 10 years | FY 2082/83 – 2091/92 | Hydro/solar/wind projects generating >1MW | Up to NPR 20M/year |

| Tourism Businesses ✈️ | 25% | Reduced to 18% | FY 2082/83 – 2084/85 | Hotels, guides, tour operators registered with NTB | Approx. NPR 3M/year |

| Agricultural Processors 🌾 | 20% | Exempt up to NPR 2M profit | FY 2082/83 onward | Value-add agri-businesses registered under VAT | Up to NPR 2M/year |

| General Startups 🚀 | 15% | 5% for 3 years | Upon registration under Startup Act | Innovative businesses under 5 years old | Approx. NPR 1.5M/year |

Startup Tax Exemption Nepal 2082/83: Proposed Game-Changing Support

The projected startup tax exemption Nepal 2082/83 provision represents perhaps the most significant entrepreneurial support measure proposed in Nepal’s fiscal policy history. Under current projections, startups with annual turnover up to NPR 10 crores could receive complete income tax exemption for five years. This provision could fundamentally transform Nepal’s startup ecosystem dynamics, pending the Department of Industry’s (DoI) guidelines for defining and registering startups.

Consider the practical impact on TechSoft Nepal, a software development company I recently consulted with in New Baneshwor. Under the previous tax regime, they projected paying NPR 3.2 million annually in income taxes on their projected NPR 8 crore turnover. With proposed exemptions, they could reinvest that entire amount into product development, market expansion, and talent acquisition. This could potentially triple their growth trajectory over the exemption period.

Startup incentives in the Nepal budget 2082/83 extend beyond tax exemptions to include comprehensive facilitation measures for women entrepreneurs (महिला उद्यमी). These provisions acknowledge the unique challenges women face in accessing capital and navigating regulatory requirements in Nepal’s traditionally patriarchal business environment. Family approval and social acceptance often determine business viability.

The intersection of government support with cultural sensitivity cannot be understated. When Sunita Shrestha launched her organic food processing business in Lalitpur, family scepticism posed greater challenges than regulatory compliance. Government backing through formal incentive programs provides legitimacy that can be crucial for family support and community acceptance in Nepal’s relationship-driven business culture.

IT Sector Tax Benefits Nepal: Digital Economy Acceleration

IT sector tax benefits in Nepal represent a quantum leap in positioning the country as a competitive destination for technology services. The proposed 75% income tax exemption on IT service exports, combined with the 5% final tax rate for exporters, creates compelling economics. This benefits both domestic companies and international businesses considering Nepal as a location for service delivery.

Digital Nepal budget highlights encompass comprehensive technology infrastructure development that extends beyond individual company benefits. The formal declaration of the IT decade (सूचना प्रविधि दशक) from 2081-91 BS signals sustained government commitment beyond single electoral cycles. This provides precisely the long-term vision that technology investors require for significant infrastructure investments.

The founder of CloudTech Solutions in Pokhara recently shared how these proposed incentives convinced him to abandon plans for relocating operations to Bangalore. Instead, he plans to expand his team from 18 to 60 developers over the next 18 months. He has a potential satellite office establishment in Biratnagar to tap into emerging tech talent in eastern Nepal.

Green Energy Incentives Nepal Budget: Environmental Leadership Initiative

Green energy incentives in Nepal budget provisions demonstrate forward-thinking environmental consciousness aligned with global sustainability trends. Proposed complete tax waivers on green hydrogen production equipment, coupled with six-year income tax exemptions for producers, position Nepal as a potential regional leader in clean energy technology. This supports the government’s broader green energy strategy for aligning with the SDGs and enhancing export potential to India and China.

These incentives align with Nepal’s abundant hydropower resources and could create synergies between traditional energy production and emerging green technologies. A renewable energy consultant working on solar projects in Mustang described how these proposed incentives could make Nepal competitive with India and China in manufacturing solar components rather than merely importing them.

Export Incentives Nepal Budget: International Competitiveness Enhancement

Export incentives in the Nepal budget include enhanced EXIM facilitation and a systematic reduction of bureaucratic barriers that have historically disadvantaged Nepali exporters. The proposed elimination of various entry fees and route permits for temporary imports of vehicles and equipment removes operational friction that added 10-15% to export costs.

The manufacturing sector’s budget priorities in Nepal reflect a sector-specific understanding of business needs. The proposed 1% customs duty on wood seasoning industry machinery and complete tax waivers on organic fertiliser production equipment acknowledge the raw material advantages Nepal possesses in these sectors. This addresses processing technology gaps.

The agricultural processing opportunities created by these projected incentives could transform Nepal’s trade balance. Currently, Nepal exports raw cardamom, tea, and other agricultural products while importing processed versions of the same commodities. These incentives could reverse this pattern by making domestic processing economically viable.

How Budget 2082/83 Affects Small Businesses Nepal: Implementation Strategy (साना व्यवसायमा प्रभाव)

Direct Impact Assessment for SMEs

The impact of Budget 2082/83 on small businesses in Nepal becomes evident when examining the cumulative effect of various projected provisions on typical small enterprise operations. The proposed five-year tax exemption for startups, combined with simplified compliance procedures and reduced guarantee requirements, creates a highly supportive environment for small-scale enterprises.

Nepal budget 2082/83 tax exemption for startup businesses can be particularly transformative for service-based enterprises that have traditionally struggled with cash flow management. A consulting firm specialising in accounting services for small businesses in Biratnagar, with which I work, projected annual savings of NPR 950,000 under the proposed provisions. These funds would directly support staff expansion from 8 to 15 employees and service diversification into digital bookkeeping.

The business registration fee changes in the Nepal budget 2082/83 include projected streamlined processes through the Office of the Company Registrar (OCR) that reduce both time and cost barriers for new enterprises. The integration with online platforms and fast-track facilities for authorised business professionals means that compliance support becomes more accessible. This is particularly important for SMEs without dedicated regulatory affairs teams.

Addressing Endemic SME Challenges

Through extensive interactions with small business owners across Nepal’s diverse geographic regions, several recurring challenges consistently emerge. Complex tax compliance procedures, unpredictable customs processes, and prohibitive operational costs dominate the concerns of entrepreneurs from Dhangadhi to Dharan. This projected budget addresses each challenge systematically.

Business tax changes in Nepal’s fiscal year 2082/83 propose simplifying compliance through automated systems and eliminating discretionary assessments that created uncertainty and opportunities for corruption. The integration of digital payment systems under proposed VAT incentive schemes will particularly benefit retail businesses. This reduces cash handling costs and improves transaction tracking accuracy.

The expansion of e-invoice systems, although requiring initial technology investment, will ultimately significantly reduce compliance costs for SMEs. A textile retailer operating in Asan Bazaar recently shared that transitioning to digital invoicing has reduced its monthly accounting expenses by 45%. This improved inventory management accuracy, enabling better customer service through faster billing processes.

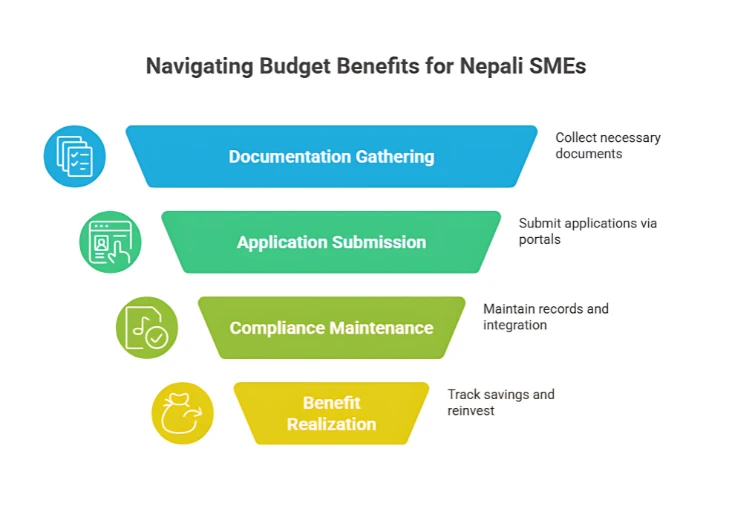

Implementation Roadmap for Small Businesses

Income tax exemption startup Nepal budget highlights require businesses to understand projected eligibility criteria and maintain proper documentation of turnover and business activities. This qualifies them for the proposed five-year exemption period. The Department of Industry (DoI) and the Inland Revenue Department (IRD) are developing simplified application processes, which are expected to be available by Shrawan 2082.

The proposed removal of banking guarantees and simplified financial procedures will particularly benefit import-dependent SMEs that previously faced cash flow constraints due to the requirement for guarantees. However, businesses must ensure they understand new automated customs valuation systems to avoid unexpected duty assessments that could disrupt operations.

Technology adoption support through Digital Nepal initiatives provides opportunities for SMEs to modernise operations. Successful implementation requires strategic planning and often external technical support. The government is establishing technology support centres in major commercial hubs, with initial locations planned for Kathmandu, Pokhara, Biratnagar, Birgunj, and Nepalgunj.

Critical Success Factor: SMEs that proactively prepare for and adopt projected digital systems and align with new tax procedures can expect a 25-30% reduction in administrative costs. This positions them favorably for government contract opportunities that increasingly prioritise digitally compliant businesses.

Economic Growth Forecast Nepal 2082/83: Feasibility Analysis (आर्थिक संभावना)

Growth Target Analysis and Investment Requirements

The economic growth forecast for Nepal 2082/83, with a target of 6%, requires approximately NPR 10 trillion in total investment. This is a massive undertaking that demands coordination between the public and private sectors. While ambitious, this target reflects the government’s recognition that incremental approaches have yielded insufficient results over the past decade. However, it must be viewed in light of Nepal’s current debt-to-GDP ratio and fiscal sustainability challenges.

Budget allocation in the business sector of Nepal demonstrates strategic prioritisation of infrastructure, technology, and manufacturing sectors that have the highest multiplier effects on economic growth. The emphasis on hydropower development and transmission line construction addresses fundamental bottlenecks that have constrained business expansion for decades. Specific projects include Dudhkoshi and Tamor hydropower initiatives.

Historical performance context suggests that achieving this target will require a significant departure from past implementation patterns. Since the 2015 earthquake and subsequent COVID-19 disruptions, no government has completed its economic growth targets. This was primarily due to unrealistic planning and implementation gaps. However, this budget’s focus on private sector enablement rather than government-led development represents a potentially more effective approach.

The Nepal Rastra Bank’s recent monetary policy has aligned with these fiscal objectives by maintaining lending rates that support private investment while controlling inflation. This coordination between fiscal and monetary policy creates a more conducive environment for sustained growth, which is required to meet the 6% target.

Private Sector Investment Opportunities Nepal Budget 2082/83: Strategic Sectors

Significant investment opportunities span multiple sectors with varying risk-return profiles. IT services exports (with a proposed 75% tax exemption) offer immediate returns for service-based businesses. Green energy production (complete equipment tax waivers) requires longer-term investment horizons but offers substantial market positioning advantages.

Manufacturing sector opportunities focus on import substitution and export promotion. The reduced customs duties on specialised machinery for wood processing, organic fertiliser production, and other industries reflect the government’s recognition of Nepal’s competitive advantages in raw material availability and regional market access opportunities.

Infrastructure development partnerships, particularly in hydropower and transmission, offer substantial opportunities for both domestic and international investors. The government’s commitment to adding 942 MW capacity creates immediate project opportunities. Transmission line development opens possibilities for private sector participation in grid modernisation.

Regional Integration and Market Access

The fiscal policy changes Nepal 2082/83 include provisions for enhanced regional integration through improved cross-border trade facilitation. Data exchange systems with India and China represent a technical infrastructure for broader economic integration that could exponentially expand market access for Nepali businesses.

For businesses in border regions, these changes could be transformative. A trading company in Birgunj that I advise currently spends 3-4 days per shipment on customs clearance procedures. The proposed automated systems and data sharing could reduce this to same-day clearance, fundamentally changing the economics of cross-border trade.

The alignment with Nepal’s anticipated transition to developing country status by 2026 creates additional market access opportunities through preferential trade arrangements. Businesses that position themselves strategically during this transition period could benefit from enhanced international market access and partnership opportunities. This requires comparing Nepal’s tax competitiveness with that of regional competitors, such as India and Bangladesh.

Tourism Industry Nepal Budget 2082/83: Digital Transformation Focus (पर्यटन उद्योग)

Tourism Sector Revival and Digital Integration

The tourism industry’s Nepal budget for 2082/83 focuses on digital infrastructure development and service quality enhancement, rather than traditional promotional approaches. The projected allocation for tourism infrastructure development includes digital payment systems, online booking platforms, and quality certification programs that address systemic issues in Nepal’s tourism sector. This supports the revival efforts for Visit Nepal 2025 following the COVID-19 pandemic.

A hotel operator in Pokhara recently described how the lack of reliable digital payment systems has forced them to maintain complex cash management procedures, which increase costs and reduce guest satisfaction. The budget’s emphasis on digital payment infrastructure could resolve such operational challenges while improving transparency and tax compliance.

The integration of tourism promotion with broader Digital Nepal initiatives creates synergies between technology development and tourism marketing. Online visa systems, digital tourist information platforms, and integrated booking systems could significantly enhance Nepal’s competitiveness in international tourism markets.

Agricultural Transformation and Agribusiness Development

With NPR 57.48 billion allocated for agriculture and livestock development, rural business opportunities extend far beyond traditional farming. The emphasis on commercial farming along major highways and corridors creates opportunities for value-added agriculture enterprises, cold storage facilities, and agro-processing industries. This includes a specific focus on irrigation infrastructure, crop insurance subsidies, and the development of cold storage facilities.

The government’s commitment to bearing 80% of agricultural insurance premiums reduces risk significantly for agri-businesses. Having worked with a vegetable farming cooperative in Chitwan that lost NPR 2.5 million due to unseasonal rainfall last year, I understand how insurance coverage can mean the difference between expansion and survival during adverse weather events.

Priority is given to high-hill crops like apples, walnuts, and maize, acknowledging Nepal’s geographic diversity and creating opportunities for specialised agricultural enterprises. The focus on organic farming and sustainable practices aligns with international market demands for environmentally responsible products.

Frequently Asked Questions

The budget proposes approximately 42 different tax rate revisions, with the most significant being the five-year complete income tax exemption for startups with annual turnover up to NPR 10 crores (subject to DoI startup definition guidelines). IT service exporters would receive 75% income tax exemption with final tax rates of only 5%. Green hydrogen producers get complete tax waivers on equipment imports plus six-year income tax exemptions. Additionally, the NPR 3 lakh bank guarantee requirement for EXIM codes would be eliminated, and minimum tax provisions for businesses with no taxable transactions would be removed.

Small businesses would benefit from significantly simplified compliance procedures, including fast-track facilities for authorized business professionals, automated customs valuation systems, and expanded e-invoice integration with the IRD. The startup tax exemption particularly benefits service-based small enterprises by eliminating income tax burden for five years. Digital payment incentive schemes reduce operational costs for retailers, while removal of various guarantee requirements improves cash flow management for import-dependent SMEs.

Yes, the budget proposes comprehensive startup ecosystem support including the five-year income tax exemption, special facilitation measures for women entrepreneurs (महिला उद्यमी), streamlined registration processes through the OCR, enhanced access to digital infrastructure, and priority consideration in government programs. The IT decade declaration (2081-91 BS) also creates long-term policy stability that startups require for planning and investment attraction.

Major opportunities include IT services export (75% tax exemption), green energy production (complete equipment tax waivers and six-year income tax exemption), manufacturing with reduced customs duties on specialized machinery, agricultural processing with insurance premium support, and infrastructure development through public-private partnerships. The hydropower sector offers immediate opportunities with 942 MW capacity addition planned, while transmission line development opens grid modernization partnerships.

The budget’s 6% growth target requires NPR 10 trillion investment, emphasizing private sector leadership in economic development. Policy changes focus on reducing business compliance costs by 25-30%, improving infrastructure reliability through power sector investments, and enhancing export competitiveness through simplified procedures. Success depends on effective implementation coordination between federal, provincial, and local governments, sustained policy commitment beyond electoral cycles, and private sector confidence in long-term policy stability, while managing fiscal sustainability concerns given Nepal’s current debt levels.

Nepal Budget 2082/83: Strategic Implementation for Business Success

As I reflect on three decades of observing Nepal’s economic evolution—from the early days of financial liberalisation in the 1990s to today’s digital transformation—this projected Nepal budget 2082/83 represents potentially the most comprehensive business support framework I’ve witnessed. The budget goes beyond mere fiscal allocation to embody a fundamental philosophical shift from government-controlled development to private sector-driven prosperity.

The proposed five-year startup tax exemption, combined with simplified compliance procedures and strategic infrastructure investments, creates significant opportunities for business development across Nepal’s diverse economic environment. However, success will ultimately depend on the effectiveness of implementation, fiscal sustainability management, and businesses’ ability to adapt to new systems, procedures, and opportunities.

The critical need for Nepali businesses is strategic preparation and early engagement. Those who proactively prepare for projected tax provisions, invest in digital system adoption, and align their operations with anticipated government priorities will secure competitive advantages that compound significantly over time. The window for early adoption benefits may be narrow—businesses that delay preparation risk missing transformative opportunities.

For established enterprises, this budget announcement offers significant expansion and modernisation pathways through projected reduced compliance costs and enhanced infrastructure reliability. For aspiring entrepreneurs, it provides the supportive regulatory and fiscal framework necessary for launching and scaling a business. For all stakeholders, it represents a definitive test of Nepal’s institutional capacity to translate visionary policy frameworks into a tangible economic reality while maintaining fiscal responsibility.

The coming months will require businesses to work strategically with tax consultants, technology providers, Nepal Rastra Bank-approved financial institutions, and relevant government agencies to maximise projected opportunities. The investment in professional guidance, system upgrades, and compliance alignment will generate substantial returns through reduced operational costs, enhanced efficiency, and access to previously unavailable market opportunities.

Nepal’s business community stands at a genuinely critical moment in the nation’s economic history. The anticipated Nepal budget 2082/83 provides comprehensive tools and a supportive framework for projections—now it’s time to prepare for building a prosperous, inclusive, and sustainable economy that this ambitious fiscal architecture envisions for Nepal’s future.